Keeping Records

Record Keeping is an important part of using a checking account. Your checking account register is used to keep checking account records. Your checking register should also be balanced monthly with your bank statement. Learning the skills to keep banking records is easy and can be mastered in a short time.

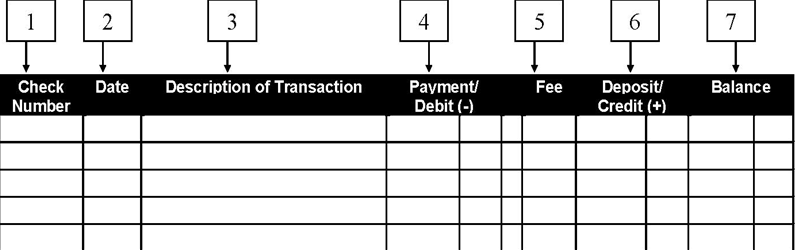

A check register is a simple form

:

Image of register from NAFCU (n,d.).

1 – The check number if entry is recording a check (if not a check this can be blank)

2 – Date of transaction - this is the date you write the check, use the ATM, etc.

3 – Description of transaction – Indicate the type of transaction and some detail (debit for alignment at tire shop)

4 – The dollar amount of out going funds - checks you write and debit use

5 – Record dollar amount of bank fees - fees vary, overdraft, bounced checks, and monthly fees should be included if charged. Also some ATM transactions also have fees.

6 – The dollar amount of incoming funds - All deposits should be entered. Transfers from other accounts like direct deposits and bank refunds should also be included.

7 – Ongoing or running balance (illustrated in how to fill out a register)